Investing Made Easy: A Beginner’s Guide to Smart Investment Strategies

Welcome, fellow money-savers! Are you curious about the world of investments but feel a bit overwhelmed? Fear not! This friendly guide is here to help you navigate the exciting realm of investing like a pro. Let’s embark on an adventure to financial freedom, one step at a time!

First things first, what exactly is investing? Simply put, investing is the act of committing money or capital with the expectation of receiving a future financial return. This can be in the form of interest, capital gains, or dividends from assets such as stocks, bonds, real estate, or mutual funds.

Now, let’s dive into some beginner-friendly investment strategies to get you started:

1. Save First, Invest Second

Before diving headfirst into investments, it’s essential to have an emergency fund in place. This financial safety net should cover 3-6 months of living expenses. Once your savings are secure, you can start thinking about investing.

2. Start Small and Regular

Investing doesn’t have to be a grand endeavor. You can start with small investments and gradually build your portfolio over time. Consider setting up automatic investments into mutual funds or exchange-traded funds (ETFs). This method, known as dollar-cost averaging, helps you buy more shares when prices are low and fewer when they’re high, which can help reduce the impact of market volatility on your investment returns.

3. Diversify Your Portfolio

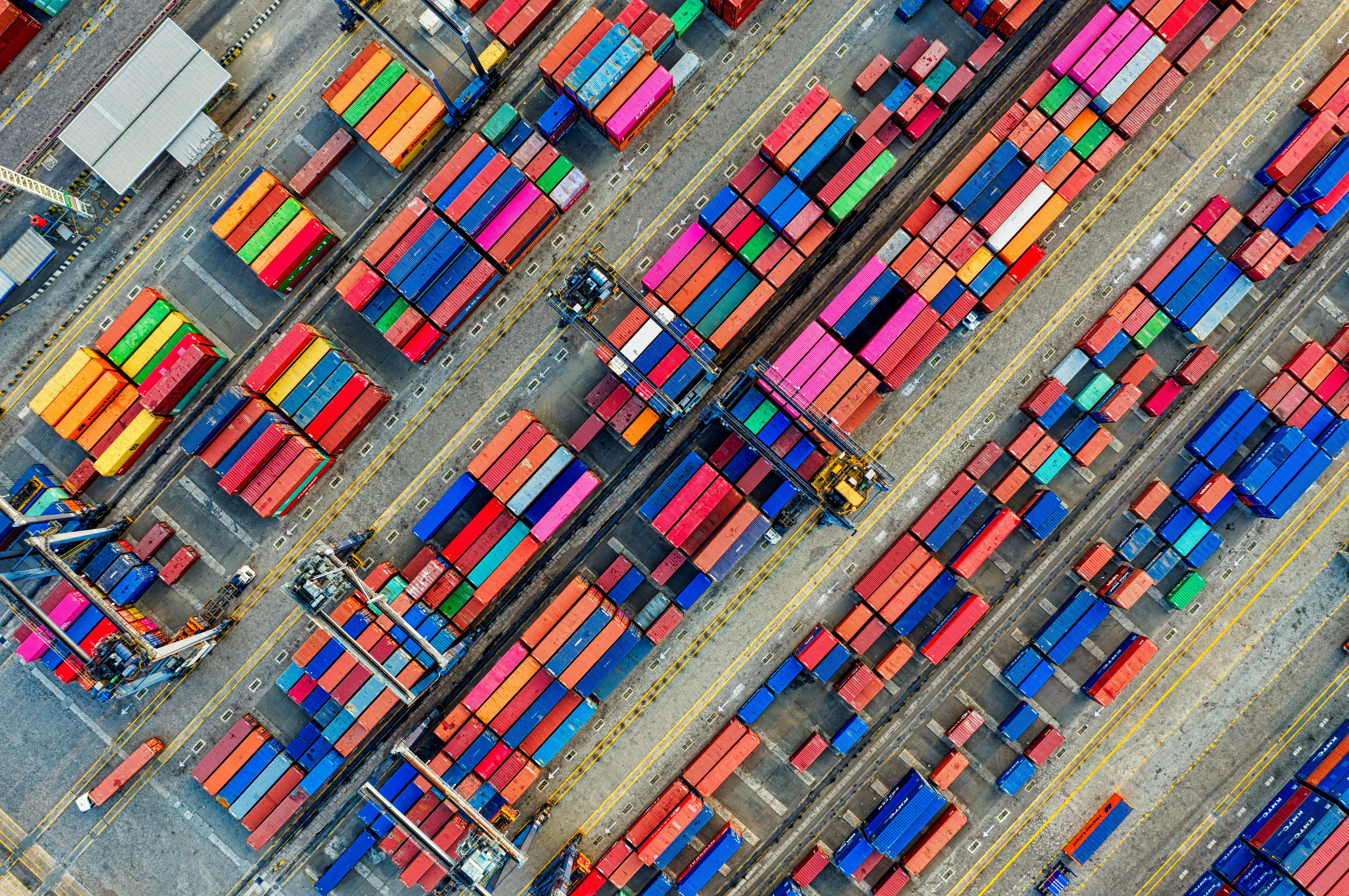

Don’t put all your eggs in one basket! Spreading investments across various asset classes such as stocks, bonds, and real estate reduces risk by limiting exposure to any single investment’s performance. A well-diversified portfolio can help you ride out market turbulence more smoothly.

4. Invest for the Long Term

Patience is a virtue when it comes to investing. Time is your ally in building wealth, as the power of compound interest works wonders over long periods. Aim for a long-term investment horizon to let your money grow steadily and consistently.

5. Understand Your Risk Tolerance

Are you comfortable with the ups and downs of the market, or do you prefer stability? Your risk tolerance will determine the types of investments that best suit you. If you’re new to investing, consider a balanced portfolio with a mix of stocks, bonds, and cash equivalents. As your confidence grows, you can adjust your portfolio to be more aggressive or conservative based on your preferences and circumstances.

6. Invest in What You Understand

Avoid getting caught up in the hype of trendy investments without understanding their underlying fundamentals. Stick to industries or companies that interest you and research their performance, prospects, and risks before investing.

7. Consider Professional Help

If the world of investing seems too complex, don’t hesitate to seek professional advice from a financial advisor or robo-advisor. They can help create an investment plan tailored to your unique needs and goals. Remember, knowledge is power, so always educate yourself about your investments and ask questions when you need clarification.

8. Stay Informed

The market changes constantly, so it’s essential to stay informed about economic news, company performance, and overall market trends. Regularly reviewing your investment portfolio can help ensure that it remains aligned with your financial goals and risk tolerance.

In conclusion, investing doesn’t have to be intimidating! By understanding the basics, starting small, diversifying your investments, being patient, considering your risk tolerance, investing in what you understand, seeking professional advice when needed, staying informed, and regularly reviewing your portfolio—you can confidently navigate the world of investments and grow your wealth. Happy investing!